Table of Content

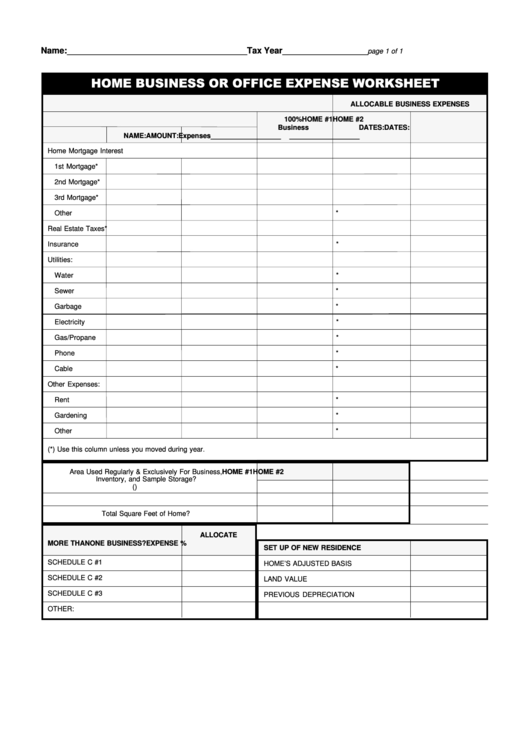

The deductible amounts are determined by several factors – such as homeowner’s earnings and tax remittance. However, home office expense is commonly claimed as an expense as long as they accrue in the course of a business operation. Simply multiply the square footage of your home that’s dedicated to your office by $5 per square foot. Unfortunately, your workspace can’t exceed 300 square feet if you use this option, so your total home office deduction is limited to $1,500 as of 2022. Expenditures for items that aren’t permanently attached to or benefit your work area as a whole are deducted on Schedule C if you’re a home business owner or independent contractor.

Direct expenses are those made specifically to the home office used for business, and not made to the rest of the home. The installation of a ceiling fan in a home office or built-in cabinet in a home office, are both examples of direct expenses incurred for the home office. Taxpayers must meet specific requirements to claim home expenses as a deduction.

Resolve to Keep the Books: 5 Ways Profitable Businesses Stay Organized

A home office does not necessarily need to be permanent, and using such space for the dual purpose of business and personal use disqualifies it from being a home office. A home office can be located in the corner of the house, with arrangements only used to transact business. However, conducting business using a laptop while sitting on the sofa among family members does not qualify for a home office. Exclusive and regular use of part of a home for business purposes, and it must be the principal place of your business are the qualifying factors for claiming home office expenses.

Therefore, someone who conducts business outside of their home but also uses their home to conduct business may still qualify for a home office deduction. You can’t include the principal part of your mortgage payments because this isn’t technically an expense. You’re simply returning the money that you borrowed to your lender. Mortgage interest and insurance can be deducted, however, subject to the necessary square footage calculations. Indirect home office expenses are partially deductible in an amount equal to the percentage of your home’s square footage that’s dedicated entirely to your business. But the IRS imposes a lot of rules regarding what’s tax deductible and what’s not, and you may only be able to claim a percentage of your costs in many cases.

Home Office Deduction at a Glance

If you maintain a home office and spend money to repair or maintain your house, you need to divide the related expenses between personal and business. Only the expenses that relate to the business portion of your home – your home office – can be included on your Form 8829. If you telecommute or are an employee who works at home, you may also qualify for the home office deduction.

When deducting expenses for a home office, it’s important to differentiate between “direct” and “indirect” expenses. Doesn't include any part of the taxpayer's property used exclusively as a hotel, motel, inn or similar business. For example, in the case of a shared space, they both cannot be deducted. Publication 587 includes additional restrictions of the simplified approach. Unrelated expenses are those that you incur as a homeowner but that do not relate to maintaining a home office.

Understanding Home Office Expenses

Indirect home office expenses are expenses that apply to the entire home and must be allocated to the portion of your home used for your business based on an allocation percentage. This is typically based on the square footage of the office divided by the square footage of the entire residence. The home must be the taxpayer's principal place of business. A taxpayer can also meet this requirement if administrative or management activities are conducted at the home and there is no other location to perform these duties.

In addition, though, your home office must be for the convenience of your employer. In plain English, this means that your employer must ask you to work out of your home. The arrangement must serve your employer’s business needs, not vice versa. ProConnect Tax adjusts the amount of indirect mortgage interest and indirect real estate taxes so that only the nonbusiness portion is reported on Schedule A.

Free Accounting Courses

It’s no secret that you generally can’t deduct certain personal expenses (e.g., homeowners insurance, utilities, and home repairs) on your federal income tax return. But if you’re using part of your home as a home office, you may be able to write off part of these expenses. To qualify for the home office deduction, you must first understand the IRS requirements.

For direct expenses, enter only the amount of expenses allowable for that specific business. These will carry directly to the form and be allowed in full. The IRS doesn't always make it simple to figure out what are personal vs. business expenses when it comes to taxes.

Be careful not to deduct this one twice if you itemize your deductions on your personal tax return. If you deduct a portion of your property taxes as part of your home office deduction, you must reduce the real estate taxes listed on your Schedule A by that amount. If the gross income from your business equals or exceeds your regular business expenses , all expenses for the business use of your home can be deducted. But if your gross income is less than your total business expenses, certain expense deductions for the business use of your home are limited. As you might expect, this test requires you to show that you exclusively use a portion of your home for business purposes on a regular basis.

This form starts with the square footage of your dedicated home office space. It compares that to your total home square footage to determine the percentage of your home used exclusively and regularly for business or to store inventory. And your home office uses 10% of the total square feet of your, you would allocate 10% of the indirect expenses to your home office deduction. You can multiply the cost of electricity, gas, trash removal, and cleaning services by your percentage of business use. Your telephone wouldn’t be included because the first telephone line to your house is considered to be for personal use.

Direct expenses are those that directly impact the office portion of your home. For example, repairing the drywall in your office space or installing carpet. These expenses relate solely to the office portion of your home and are deductible in full. For example, assume you set aside one room in your home as your home office.

Be sure you use this structure only for business purposes — you can’t store your car there. An Accountability Plan is the method S Corp owners should employ to take a deduction of their home office expenses. Under this structure, the owner would submit a reimbursement request to the business, and the business would reimburse the owner.

No comments:

Post a Comment